Recognizing the Expense Cost Savings of Medicare Advantage Insurance

As people browse the facility landscape of health care insurance coverage options, understanding the subtleties of price savings within Medicare Advantage plans comes to be significantly critical. The possible monetary benefits that these strategies use can dramatically influence a person's health care costs, offering a cost-effective choice to standard Medicare coverage. By diving into the intricacies of exactly how Medicare Advantage intends accomplish these cost savings, people can get important insights right into optimizing their healthcare insurance coverage while potentially lowering out-of-pocket costs. Beyond the surface-level comparisons, revealing the underlying variables driving these expense savings reveals a realm of opportunities that can enhance both monetary wellness and accessibility to top quality care.

Advantages of Medicare Benefit Plans

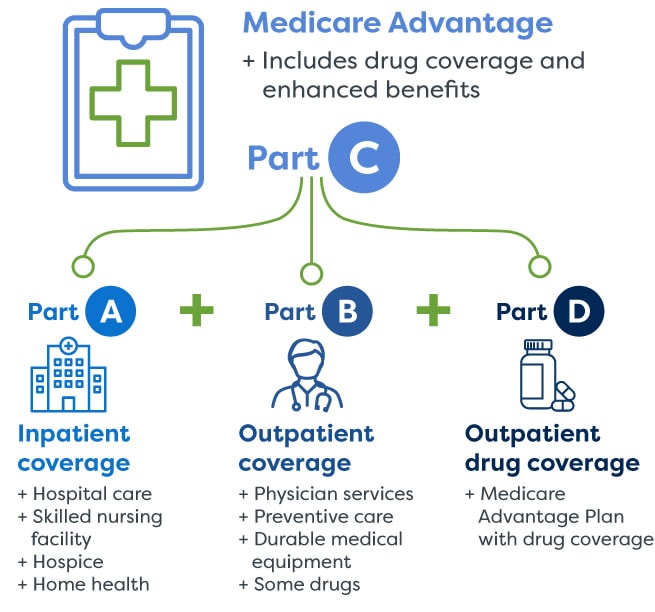

Medicare Benefit intends offer a detailed selection of advantages that go beyond traditional Medicare protection, providing enrollees with improved medical care services and cost-saving opportunities. These plans often include coverage for solutions such as oral, vision, hearing, and prescription medicines, which are not typically covered under initial Medicare. By combining these different health care needs into one plan, Medicare Benefit beneficiaries can enjoy the ease of having all their clinical services covered under a single plan.

In Addition, Medicare Advantage plans often incorporate extra rewards like fitness center subscriptions, telehealth solutions, and wellness programs to advertise preventive treatment and overall wellness. These value-added advantages intend to improve the top quality of treatment for enrollees while additionally aiding them reduce out-of-pocket costs that they may otherwise sustain with typical Medicare.

Essentially, the benefits of Medicare Benefit intends expand past standard medical protection, offering a more holistic approach to medical care that focuses on preventative procedures, ease, and cost-effectiveness for beneficiaries.

Cost-Effective Protection Options

The improved benefits provided by Medicare Benefit intends not only boost health care coverage yet also existing recipients with a series of cost-efficient coverage alternatives to consider. These plans typically include extra benefits beyond Original Medicare, such as vision, dental, hearing, and prescription medication insurance coverage, all packed into one comprehensive plan (Medicare advantage plans near me). By offering these added services, Medicare Benefit strategies can aid individuals save cash by lowering out-of-pocket costs that would certainly otherwise be incurred independently

In Addition, some Medicare Advantage plans have lower regular monthly costs contrasted to typical Medicare, making them an attractive option for those aiming to handle their healthcare expenses properly. The economical insurance coverage choices available via Medicare Benefit strategies can offer beneficiaries with extensive healthcare insurance coverage while possibly conserving them money over time.

Potential Out-of-Pocket Cost Savings

In Addition, Medicare Benefit prepares typically include fringe benefits not covered by Initial Medicare, such as vision, oral, hearing, and prescription medicine protection. By bundling these services right into one comprehensive strategy, beneficiaries can conserve money on out-of-pocket expenditures that would or else be incurred if they needed to acquire separate insurance coverage or pay for solutions expense.

Value-added Providers and Advantages

Value-added services and advantages offered by Medicare Advantage plans enhance the total healthcare experience for plan members. These extra services exceed what Original Medicare covers, offering extras such as vision, dental, listening to insurance coverage, fitness programs, and even prescription drug insurance coverage in some instances. By integrating these supplemental advantages, Medicare Advantage prepares goal to give thorough treatment that resolves not only medical needs however also total health.

Furthermore, some Medicare Advantage strategies may use telehealth solutions, which have actually ended up being progressively beneficial in today's digital age. This enables plan participants to talk to healthcare suppliers from another location, saving money and time Going Here while making sure accessibility to required medical attention. Medicare advantage plans near me. In addition, several strategies offer care control solutions, assisting members have a peek at this site browse the complexities of the health care system and ensuring they receive appropriate and prompt treatment

Variables Affecting Cost Cost Savings

Variables influencing price financial savings within Medicare Benefit plans are necessary to comprehend for both companies and recipients. One crucial factor adding to cost financial savings is the focus on precautionary treatment and care sychronisation in Medicare Benefit strategies. By focusing on preventative solutions, such as screenings and wellness brows through, these plans aim to discover and address wellness issues beforehand, eventually decreasing the demand for expensive therapies or hospital stays. Another aspect is the network framework of Medicare Benefit prepares, which usually have contracts with certain health care carriers to deliver services at negotiated rates. This network configuration can result in set you back financial savings contrasted to conventional Medicare fee-for-service models, where expenses might be higher as a result of less regulated utilization of solutions. Additionally, Medicare Benefit plans may provide motivations for beneficiaries to make use of in-network companies, further promoting economical care shipment. Comprehending these aspects can aid service providers and beneficiaries make educated decisions to optimize price financial savings while keeping quality treatment within Medicare Benefit plans.

Verdict

Comments on “Discover Resident Options: Medicare Advantage Plans Near Me”